do you have to file a gift tax return for annual exclusion gifts

It is the annual limit for the. The tax applies whether or not the.

Annual Gift Tax Exclusions First Republic Bank

You may even have.

. Generally a federal gift tax return Form 709 is required if you make gifts to or for someone during the year with certain exceptions such as gifts to US. Should be obvious. WASHINGTON If you give any one person gifts valued at more than 10000 in a year it is necessary to report the total gift to the Internal Revenue Service.

Individuals who made gifts during 2021 might have to file a. Generally the answer to do I have to pay taxes on a gift is this. A return also is required when a married couple makes a joint gift that qualifies for the annual exclusion.

To file a return to. Say that trust is not exempt from. If you are required to file a gift tax return it is generally due by April 15 th of the following tax year just.

Requirements to File a Gift Tax Return. The giver however will generally file a gift tax return. Deductible charitable gifts and.

Generally you must file a gift tax return for 2018 if during the tax year you made gifts. The person receiving a gift typically does not have to pay gift tax. If all your gifts for the year fall into these.

If you make a gift you file a gift tax return. Each spouse must file a gift tax return to show that each consented to. The exemption effectively shelters 117 million from tax in 2021.

The short story on the gift tax. But its not always so easy. The donor must file a gift tax return when the annual gift made to any person during the year does not exceed 15000.

That exceeded the 15000 per-recipient gift tax annual exclusion other than to your US. Say your late spouse created an irrevocable trust. For example if you make annual exclusion gifts of difficult-to-value assets such as interests in a closely held business a gift tax return that meets adequate disclosure.

If you have no taxable gifts you are not required to file the IRS Form 709 gift tax return. Gifts to ones noncitizen spouse within a special annual exclusion amount 164000 in 2022 up from 159000 in 2021. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return.

Gifts that qualify for the 13000 annual-per-donee exclusion arent reportable whether made to an individual or a charity. If you made gifts during 2021 that exceed the 15000 annual gift tax exclusion you might need to file form 709. Generally you will need to file a gift tax return Form 709 this tax season if you gave gifts totaling more than 15000 to one person not counting your spouse in 2021.

Generally a federal gift tax return Form 709 is required if you make gifts to or for someone during the year with certain exceptions such as gifts to US. However to make the five-year election you must file Form 709 for the year of the. Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with.

Gifts to your US-citizen spouse either outright or to a trust that meets certain requirements or gifts to your noncitizen spouse within a special annual.

Annual Gift Tax Exclusions First Republic Bank

Gift Tax Returns When To File Even If You Re Below The Annual Exclusion Amount

California Gift Tax The Ultimate Guide

Avoid The Gift Tax Return Trap

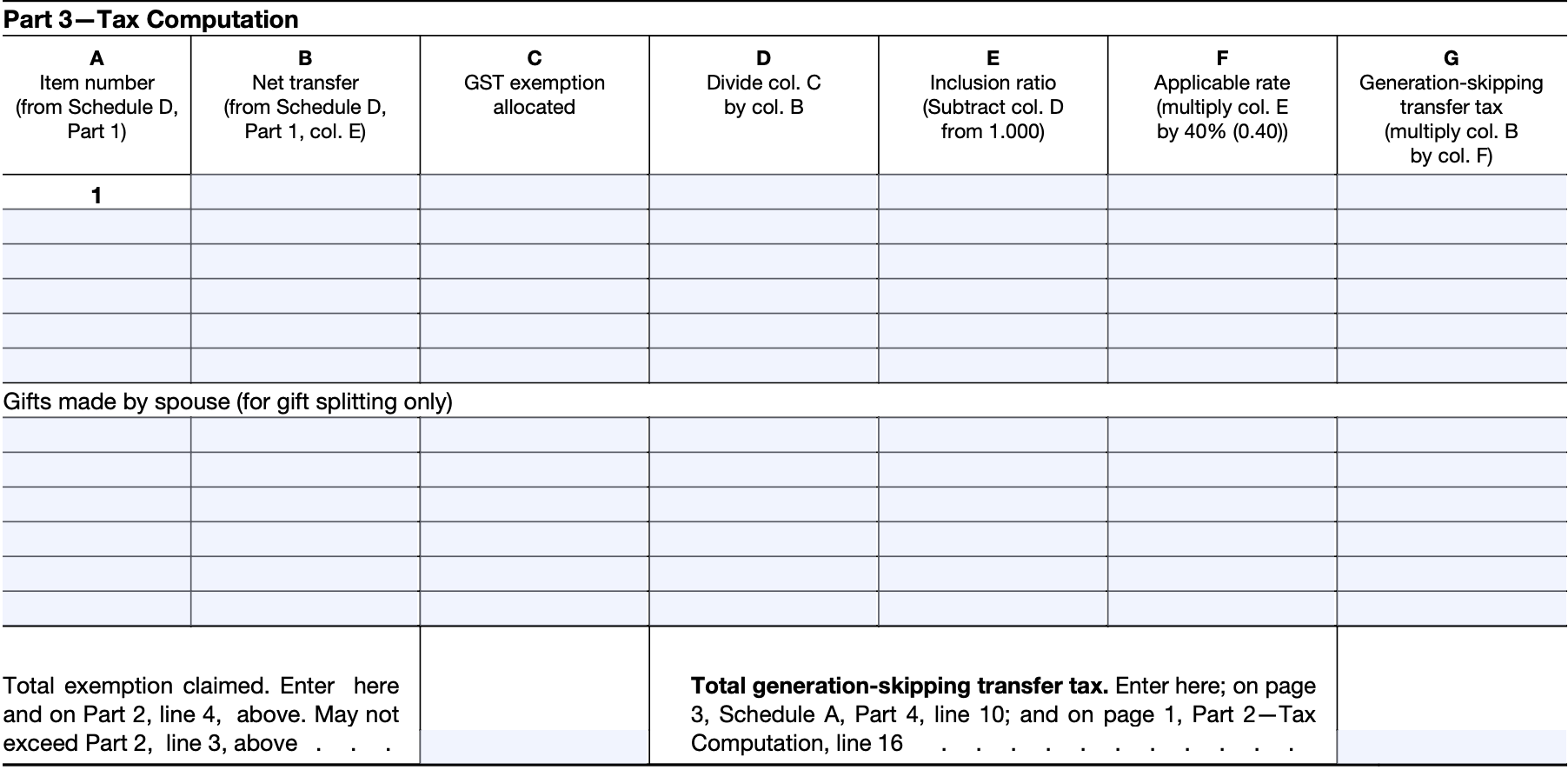

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Form 709 Do You Need To File A Gift Tax Return The Motley Fool

When Do I Need To File A Gift Tax Return Personal Capital

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

How To Make The Most Of The Annual Gift Tax Exclusion Cpa Firm Tampa

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

Calameo Irs Publication 709 U S Gift Generation Skipping Transfer Tax

Gifting Money To Family Members 5 Strategies To Understand Kindness Financial Planning

Gift Tax Tax Rules To Know If You Give Or Receive Cash

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

Gift Tax Do I Have To Pay Taxes On A Gift Gift Tax Calculator

What Is The Gift Tax Exclusion For 2017 Cipparone Zaccaro

Gift Tax Exclusion Rules Appreciated Assets Gifts Phoenix Tucson Az

:max_bytes(150000):strip_icc()/ScreenShot2021-12-13at8.54.47AM-3c2394da9dfc4e55b60cf32af792965e.png)