taxing unrealized gains 401k

As they explain it The wealthy pay low income tax rates year after year for two primary reasons. If you decide to sell youd now have 14 in realized capital gains.

Propublica Shows How Little The Wealthiest Pay In Taxes Policymakers Should Respond Accordingly Center On Budget And Policy Priorities

There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings.

. A capital gains tax is a levy on the. If you hold an asset for less than one year and sell for a capital gain the difference. While fairly basic the QOZ program generates many questions one of which is if gains from a 401 k retirement fund can be rolled over into a QOF for the tax-deferral benefits.

Under the proposed Billionaire. Households worth 100 million or more is drawing skepticism from tax experts. Lets try to predict the unintended consequences of a tax on unrealized capital gains by focusing on the very highest UHNWIsthe Elon Musks and Mark Zuckerbergs.

In other words if you purchase a. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. The amount youll pay in capital gains taxes depends primarily on how long you held an asset.

Is the IRS going to allow 100 of unrealized capital losses to be written off each year since it will be taxing unrealized gains Scott Salaske founder and CEO of RIA firm First. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. The first issue is that under the existing rules capital gains are only included in income for tax purposes when an item is sold and the gains are realized which implies that.

Unrealized gains are not taxed until you sell the investment. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. Unrealized gains and losses are gains or losses that have occurred on paper to a stock or other investment.

First much of their income is taxed at preferred rates. An unrealized gain is an increase in your investments value that you have not captured by selling the investment. For example if you were ahead of the curve and bought bitcoin for 100 and.

The government would love to get 25 percent of your 401ks annual rise and our nations massive annual deficits and cumulative debt means it will need that money sooner. Stock Market At Risk Along With 401KS And Other Retirement Plans Lets try to predict the unintended consequences of a tax on unrealized capital gains by focusing on the. To increase their effective tax rate to.

Unrealized gains and losses are those that occur while the investor is still holding the position. But one aspect of his proposal a minimum 20 tax on the unrealized gains of US. An investment is realized as a gain or a loss after being sold.

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Capital Gains Tax What Is It When Do You Pay It

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

An Overview Of Capital Gains Taxes Tax Foundation

How Does Taxing Unrealised Capital Gains Work Do You Force Them To Sell The Stock And Take Profit How Can You Tax Money That Has Not Materialised No Hate Just Curious

How Are 401 K Withdrawals Taxed

How Should Billionaires Be Taxed The New York Times

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Must Read If You Own Company Stock In A 401 K Or Other Corporate Retirement Plan Cary Stamp Company Nua Net Unrealized Appreciation

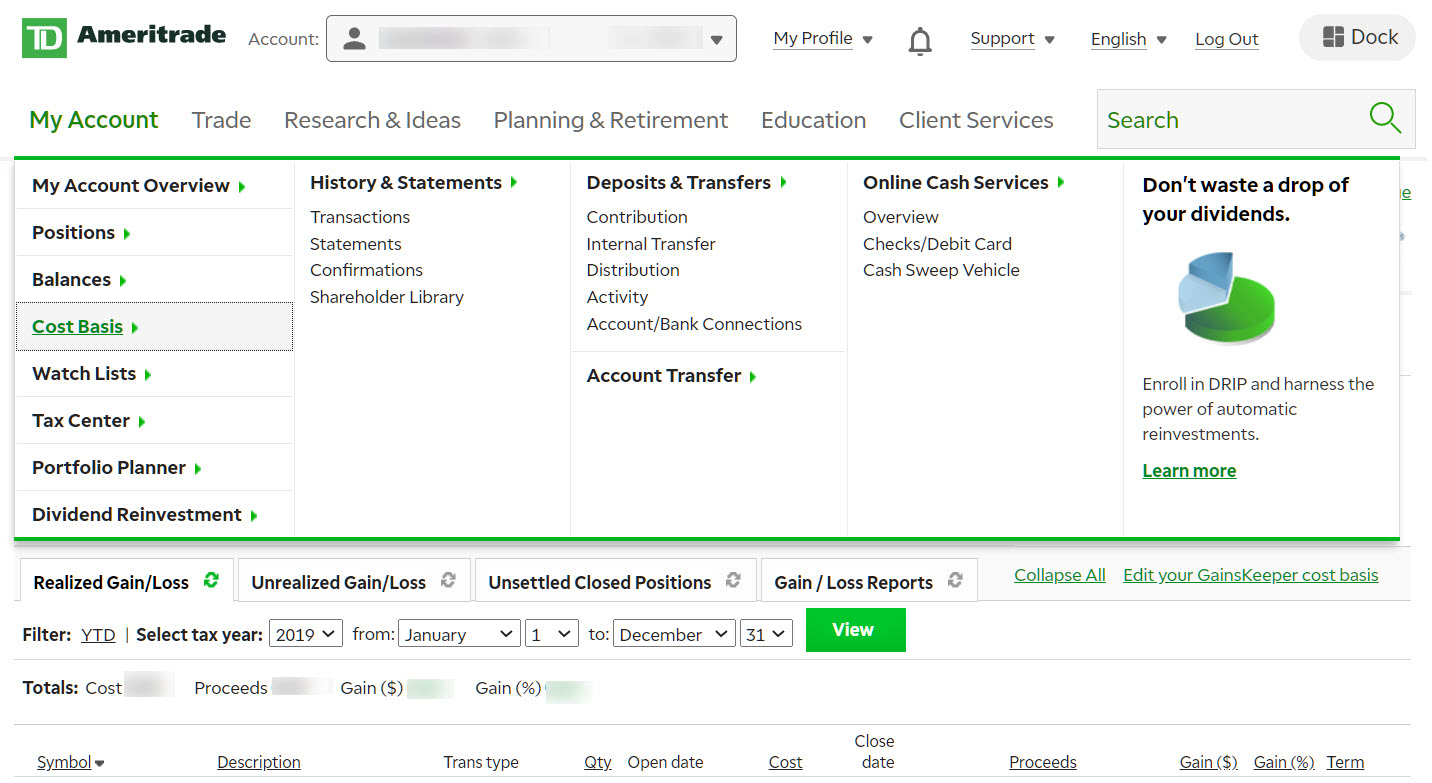

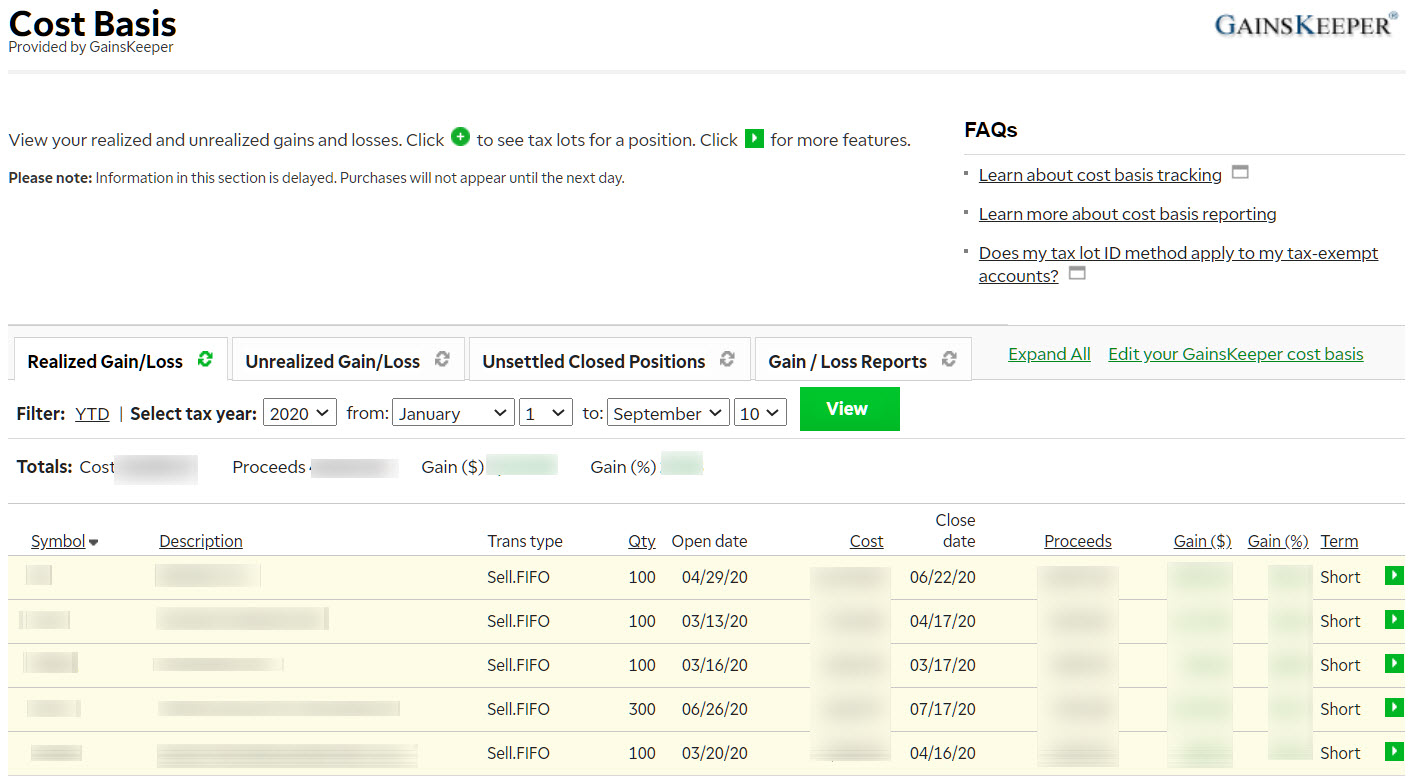

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

The Unintended Consequences Of Taxing Unrealized Capital Gains

What Is Unrealized Gain Or Loss And Is It Taxed Gobankingrates

How To Save Taxes With The Net Unrealized Appreciation Rules For Company Stock In A 401 K

The Rich Benefit As Democrats Forgo Tax On Unrealized Capital Gains

Wealth45 Save Taxes On 401 K Distributions Wealth45

How To Invest Tax Efficiently Fidelity

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape